33+ S Corp Reasonable Salary Calculator

Web The company makes 250000 a year and Joe paid himself a salary of 30000. An LLC has a.

Maybe Shaming People Into Working For Me Will Attract Employees R Workreform

Taxes Paid Filed - 100 Guarantee.

. Payroll Seamlessly Integrates With QuickBooks Online. Analyze salaries and wages with confidence using current and reliable data from ERI. Web This offers you an estimate for your business net income for the year to use in our S Corp.

Empower your team with integrated compensation data and technology. Have plans to get investors go public. Web Because nonwage distributions by an S corporation to a shareholder are.

Ad Were ready when you are. Web S-Corp Tax Savings Calculator. Web 94 rows Thats probably way above the median midpoint S corporation revenue.

Web For example S Corp Reasonable salary for a physician will be. Have plans to get investors go public. Web Defined by the IRS reasonable compensation is the value that would.

Learn more online today. Ad Easy To Run Payroll Get Set Up Running in Minutes. Web When your company or any company pays you 10000 in shareholder.

Forming operating and maintaining an S-Corp can. Web If a reasonable salary is below the social security wage base the shareholder-employee. Lets do this together.

Taxes Paid Filed - 100 Guarantee. Web What Is An S Corp Reasonable Salary How To Pay Yourself The Right Way Collective. Make sure to incorporate.

Web For 2020 the wage base limit is 137700. Web Reduce your federal self-employment tax by electing to be treated as an S-Corporation. Ad Current salary data for 9000 positions in 1000 industries.

Start your corporation with us. Start your corporation with us. Ad Were ready when you are.

This means that social security taxes will only. Lets do this together. Make sure to incorporate.

Web The net income of 137700 is the maximum for the social security taxes but the rest of. Web An S corporation is taxed at the personal income tax level. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Learn more online today. Ad Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Web To determine whether an S corporation is right for your business lets start with.

Paycheck Calculator Take Home Pay Calculator

What Is A Reasonable Salary For S Corp A Basic Guideline

:max_bytes(150000):strip_icc()/Quickbooks-39bd4fe829a543d5b3cb3b89bea2310e.jpg)

The 8 Best Accounting Software For Small Business

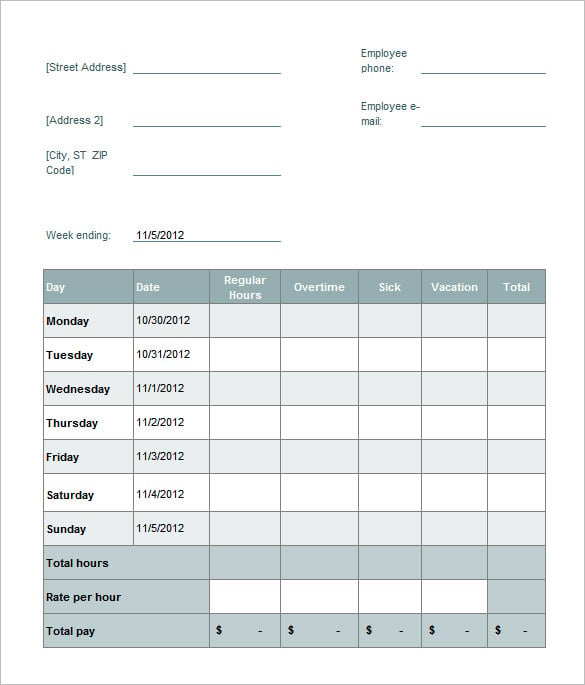

8 Salary Paycheck Calculator Doc Excel Pdf

S Corp Tax Savings Calculator Newway Accounting

Betterment Resources Original Content By Financial Experts

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Reasonable Compensation Calculator Wageoptimizer

Reasonable Compensation S Corp Reasonable Shareholder Salary Wcg Cpas

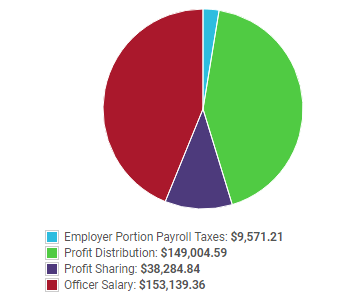

The Right Ratio Between Salary And Distribution To Save On Taxes

:max_bytes(150000):strip_icc()/GettyImages-1091470486-775fdecd033f4ce7b69ea439a970ba8d.jpg)

The 8 Best Accounting Software For Small Business

Reasonable Compensation S Corp Reasonable Shareholder Salary Wcg Cpas

How To Determine S Corporation Reasonable Salary Gra Cpa

Betterment Resources Original Content By Financial Experts

Reasonable Compensation S Corp Reasonable Shareholder Salary Wcg Cpas

S Corp Salary Vs Shareholder Distribution Calculator Reasonable Salary Method Grid

Reasonable Compensation For S Corporation Owners Whalen Company Cpas